An Advice Fee Revolution?

It’s often rumored (but less proven) that Einstein once claimed compounding to be the most powerful force in the universe. This can be great for investment portfolios benefitting from consistent long-term annual market growth, but if you think of it from a financial advice fee perspective, that same force applies as a drain on your returns.

In Australia and the United Kingdom, regulators recently mandated financial advice firms to conduct annual value and charge assessments, and to re-contract with their clients, providing an opportunity to regularly decide if their Advisor is providing a service that is valuable and relevant to their financial goals and circumstances. We believe charge and advice value regulation in the U.S. is due for an overhaul.

You say you got a real solution. Well, you know…we’d all love to see the plan.”

—John Lennon, 1968

Charges have a significant influence on your long-term advice outcomes

When we formed our practice, we wanted to be different and add value to our clients, their families, and the broader society within which our advice creates impact. As part of this differentiation, we looked at the typical fee structure of registered planning and investment advisor firms.

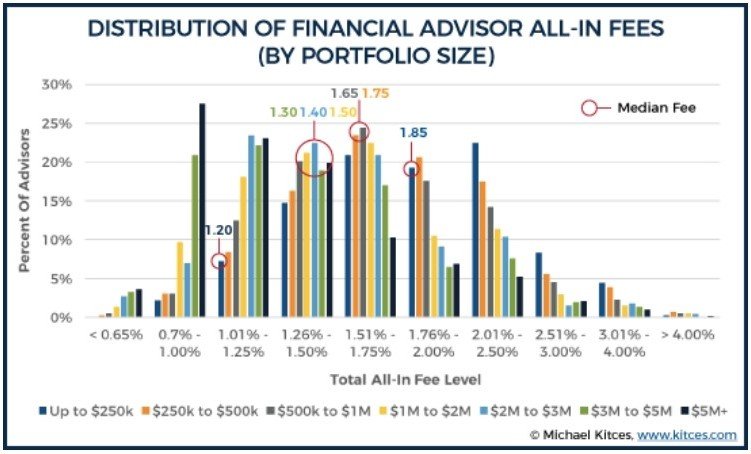

Advisory HQ (2023) found the average asset-based financial advice fee currently stands at 1.18% for accounts less than $100k and 1% for those above $1M. When adding in account, trading and investment management expenses, according to Michael Kitces (Kitces.com, 2017), median all-in cost of a financial advisor serving under-$250k portfolios is 1.85%, dropping to 1.75% for portfolios up to $500k, 1.65% up to $1M, and 1.5% for portfolios over $1M, dropping to $1.4% over $2M, 1.3% over $3M, and 1.2% over $5M.

Advice + Account + Investment + Trading = Total Expenses

Do Advisors deserve a perpetual pay rise?

Whilst we believe it’s important for your trusted Advisor to be linked to portfolio success, paying them to participate in a significant share of its market-based returns, less relevant to their advice provision, is hard to justify particularly if you break those costs down as a time-based fee over a long-term period. For example, $500,000 invested over 20 years, achieving average annualized growth of 9%, with a tiered annual advice charge averaging 0.8%, will attract advice costs of $384,000. That’s $960/hour assuming 20 hours per year of advice and administration work, and total charges (including investment, trading and account) of $556,000.

Our ongoing annual advice charge is 0.65% for accounts up to $2.5M and negotiable as a fixed consultancy fee above, on the full assets, creating a fairer, value-based compensation.

We also offer new clients the ability to pay for a one-off personal financial and investment plan, allowing those with less complex needs and stronger investing capabilities, the chance to create planning without concern for ongoing advisor management.

We believe trust is earned and that’s why managing wealth for our clients and their families is a privilege. Our Fair Fee Promise and Service Charter creates bespoke ongoing advice arrangements that give clients confidence and transparency that we are working in their best interests, and they are paying us a fair price for doing so.