Our Planning & Investment Approach

Financial and Investment Planning are linked to your personal family circumstances. Both should be considered in the context of a lifecycle and your positioning within it.

In our opinion, it’s harder to construct an effective investment strategy without first establishing your personal financial plan, formulated in careful consultation with you and your family.

We believe that advice must be free from remuneration bias and commission conflicts, which only independence can provide.

Planning is bringing the future into the present so that you can do something about it now. ”

—Alan Lakein

Good Financial Advice is a Game Changer

Recent studies by Vanguard, TRowe Price, and Kaplan have evidenced human-based financial advice adding 1 - 3% additional annualized return versus a self-managed approach. This has become known as Advisor Alpha.

On a compound basis the 2% range of this Alpha makes a significant difference to personal wealth, so it’s important to know and understand which advisor attributes will create the most difference for you and your family.

Not all Financial Advisors are created equal (or independent!).

Our 3 Step Process

DISCOVERY

Usually, 60 to 80 minutes to find out more about you, your family, and your goals. We treat this as a consultation, although we aim to be doing less talking and more listening because it’s about you.

ADVICE FORMULATION

Deploying the latest cash flow and financial planning software detailed in the short video below, we establish your financial plan, risk budget and personal investment benchmark, which we use to construct your Risk Score and strategic asset allocation. We consult with you at this stage to ensure it represents an accurate framework to reach your short, medium, and long-term goals.

PRESENTATION & IMPLEMENTATION

Presenting your personal, holistic, goal-based financial & investment plan forms the structure of your new accounts with our custodian, Charles Schwab. We’ll explain your account set-up process and present your Service Charter including a bespoke review schedule. We’ll also refer you (if relevant) to recommended external advisors, such as Estate Attorneys and CPAs.

Our Investment Policy

According to the CFA Institute from their study in 2012, updated in 2022, Asset Allocation drives more than 90% of portfolio returns over long term periods. Our strategy is, therefore, a top-down approach that prioritises asset class exposure over security selection.

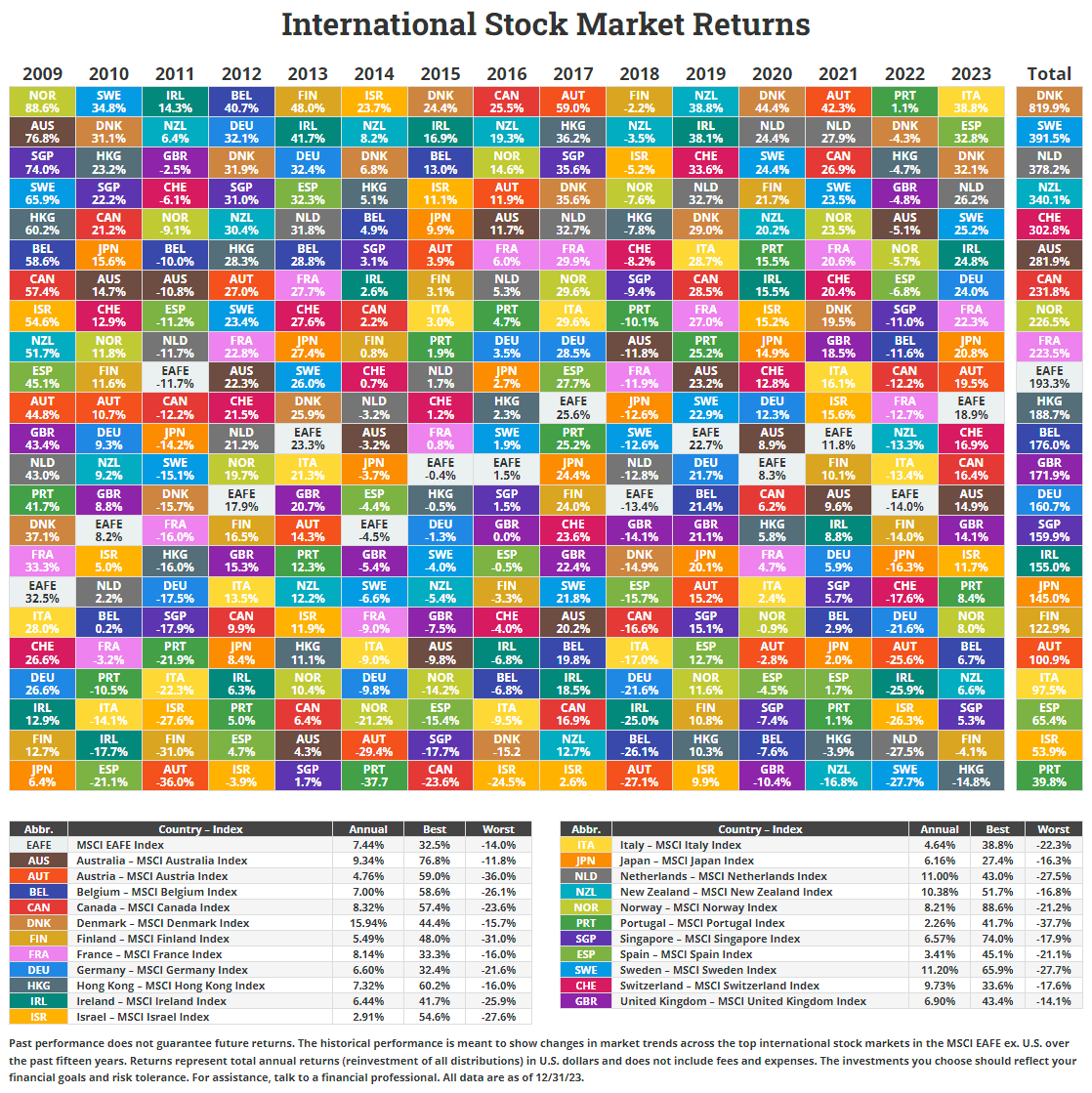

Since 2011, international market growth has been relatively weak whilst the U.S. technology sector represented recently by the "Mag Seven", has caused the S&P 500 to grow narrower in capitalization.

International markets currently offer opportunities for value investors, but also diversification across countries, sectors and currencies as shown in the charts left and below.

Globally Diverse Opportunities

U.S. stock market outperformance is down to low interest rates, tax cuts implemented in 2017, the growth of technology and index investing powering larger companies on the S&P 500, but the future’s not what it used to be. Higher global interest rates since 2021 have brought market volatility, which has aided value investing, more aligned with active fund management and green shoots across international markets since 2022.

For investors in the U.S. with long asset time horizons, a 60/40 U.S./International weighted stock market portfolio has never looked more attractive from valuation, diversification and currency standpoints. The skill moving forward from an advice perspective, however, is understanding how and where to deploy passive and active management to capture performance and cost efficiencies.

Source: novelinvestor.com

Source: novelinvestor.com